Sony Crackle locked in exclusive streaming rights to carry Ubisoft esports documentary, “To Win it All: The Road to The Six Invitational,” which is set to debut on the free streaming network tomorrow, leading up to the Saturday, February 16 Six Invitational in Montreal. The documentary follows “three top players from around the globe as they try to balance their lives, relationships, and training all while chasing a chance to compete in the Six Invitational and win a life-changing over $1MM prize pool.”

Twitter reports that 2018 saw a billion Tweets about gaming globally, posting listings of the year’s top brass.

Regions that Tweeted most about gaming in 2018:

- Japan

- United States

- United Kingdom

- France

- Korea

- Spain

- Brazil

- Canada

- Mexico

- Germany

The most-Tweeted about games last year:

- Fate/Grand Order (@fgoproject)

- Fortnite (@FortniteGame)

- Monster Strike (@MStrikeOfficial)

- Splatoon (@SplatoonJP)

- PlayerUnknown’s Battlegrounds (@PUBG)

- Granblue Fantasy (@granbluefantasy)

- Ensemble Stars (@ensemble_stars)

- Super Smash Brothers (@NintendoAmerica)

- Overwatch (@PlayOverwatch)

- Final Fantasy (@FinalFantasy)

The most talked about gaming events of the year:

- E3

- Tokyo Game Show 2018

- The Game Awards 2018

- 2018 League of Legends World Championship

- Overwatch League Inaugural Season Championship

- ELEAGUE Major: Boston 2018

- FACEIT Major: London 2018

- Gamescom 2018

- BlizzCon 2018

- TwitchCon 2018

Network Next shifted its plans into high gear, announcing that the company raised a $4.4 million seed round designed to help launch the internet fast lane for games and other interactive content. The seed round was led by BITKRAFT Esports Ventures, with additional investment coming from Bain Capital Ventures, Velo Capital Partners, and independent game developer, Psyonix. Network Next also announced that Psyonix has signed on as Network Next’s first game customer with the integration in Rocket League going live in the coming months. “We believe that game traffic should be prioritized above other internet traffic and could not be more thrilled to partner with investors who share that belief,” said Glenn Fiedler, CEO of Network Next and a 20-year veteran of game development. “With this new investment, we’ll be able to grow our team and continue the development of our technology, which will ensure that we can deliver on our vision.”

Swiss cable operator UPC Switzerland is launching its first esports channel, the German eSports1 on its platform this week. The platform goes live today as part of the operator’s MySports Pro premium offering and include at least 1,200 live hours of esports events annually, as well as highlights and magazine programs produced in-house.

Texas Esports, the majority owner of Dallas-based Infinite Esports & Entertainment, is looking to sell its stake in the company for at least $150 million starting early February, according to an Esports Insider report. Infinite Esports & Entertainment oversees and owns the likes of OpTic Gaming and Obey Alliance, LCS partner OpTic LoL, and Overwatch League franchise Houston Outlaws.

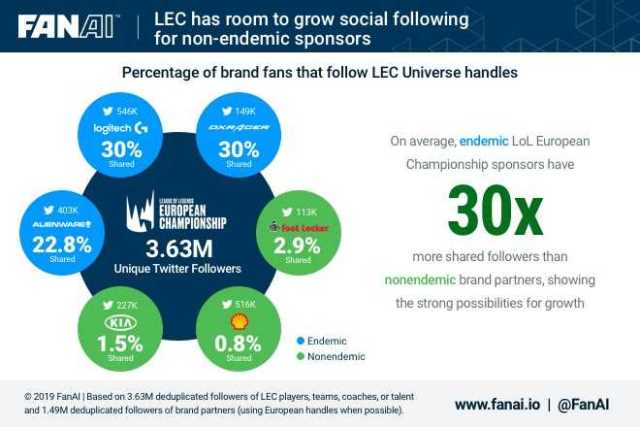

The highly anticipated return of the newly franchised and rebranded League of Legends European Championship took place over the weekend. Those who tuned into the debut saw sponsored content from the league’s new high-profile sponsors. The LEC is supported by 6 brands, 3 endemic esports brands, and 3 nonendemics that are looking to gain a foothold with the highly valuable esports audience. FanAI investigated the established support these brands have with the esports audience as the season starts. Using European focused brand handles where possible, each sponsors’ followers on twitter were compared with the unique followers of LEC related handles. Nonendemic sponsors Kia Motors, Shell, and Foot Locker EU share, on average, 3.5k followers with LEC handles. In contrast, the 3 endemic sponsors, Alienware, Logitech G, and DXRacer EU reach, on average, 100k LEC fans through their twitter accounts. The disparity in shared followers shows just how much room for growth is available to these new sponsor brands with the 3.63M LEC fans on Twitter. This is great news for these brands since league sponsorship has proven to be an excellent way to forge a connection with the growing esports audience.

The US gaming industry broke records in 2018 to hit an estimated $43.4 billion in sales, according to The NPD Group, marking a rise of 18% year-over-year. Hardware revenue, including peripherals, hit $7.5 billion, according to the report, for a markup of 15% year-over-year, while software revenue was up 18% year-over-year to $35.8 billion. Accessory and game card spending for 2018 grew 33% year-over-year to $4.5 billion, an all-time high.

Esports retail and merchandise company We Are Nations acquired Sector Six Apparel, an esports apparel brand specializing in jerseys and custom team wear for all. “As Nations expands into working with global multi-channel projects, we wanted to make sure we stayed very good at supplying basic quality products to everyone at a good price and with ease of use and scale,” said We Are Nations CEO Patrick Mahoney.

POWER PLAYER: World Gaming’s Wim Stocks

Following the news of the addition of Call of Duty: Black Ops 4 to its lineup, Cynopsis caught up with Wim Stocks, CEO and general manager of World Gaming, to discuss the news and the state of the company.

Stocks on 2019 objectives: The great momentum we had for both WorldGaming Network and Collegiate Starleague coming out of 2018 sets us up and serves us (and our player communities) extremely well as we get underway in 2019. The presence for our competitive gaming programming, our online tournaments and leagues platforms, our events, our content, and our brands continue to build around our mission for supporting developmental, grassroots, and amateur players; ‘inspiring aspiring gamers’ as we like to say. Last year proved to be a pivotal time for providing more clarity for pro leagues, teams & franchises, activations, and broadcasts (OWL, LCS, NBA2K), so as the pro dynamics start getting more defined, so too does this help define the marketplaces and related programming supporting developmental and amateur players, the opportunities are growing for players to find organized ‘feeder’ events and content to help improve their competitive skills and which also become more appealing and attractive, while helping competitive players understand the various ways to find their places and status in the elite ranks.

On challenges: There are still many misperceptions about competitive gaming that are unhealthy for the longer term (and larger) development and for growing presence, engagement, and involvement in the space. While esports enthusiasts and fans/audiences who completely comprehend the space continue to grow in size and deepen their involvement and engagement with competitive gaming events, programming, content, favorite players and teams and the related merchandise (as well as with the brands who have dived in completely enthusiastically and authentically), and are the true fans and bread/butter for our industry, the traditional mainstream still lags. In the truest sense, esports enthusiasts and endemics frankly couldn’t care less about the traditional mainstream ‘getting it’, yet the economic engines of big brand sponsorship, advertising, broadcast, etc., are all waiting for the traditional mainstream to ‘get it’, understand it, embrace and consume esports for all which it stands. My point is this: every hour of every day we are involved in the esports sphere; we sense it, feel it, see more clearly every day the growing adoption and understanding of esports and how brands want to participate in and integrate with the esports experience, the growing awareness and the excitement that participating and spectating offers players and audiences alike, the amazingly positive halo effect this affords the invested and involved brands. I predict there will be a tipping point (already happening in certain segments), and when it happens it will be a massive wave; the question remains as to how soon it materializes.

On the company’s biggest success in 2018: We feel great about what we accomplished last year in three areas: 1). We continue to prove our value for the amateur realms, certainly providing players high-quality experiences and opportunities to improve and excel, but also for our all-important publisher partners, where the large open accessible funnel we create for aspiring players keeps the audiences for and engagement with their respective games vibrant while all the while feeding the elite ranks – we accomplish this for the ‘general’ competitive gaming market via WGN and for the collegiate ranks via CSL. 2). We have shown brands new to esports great and economical ways to attach authentically and effectively to a variety of our esports activations, and have demonstrated tremendous ROIs as a result, as well as creating fun, distinctive, new sorts of experiential integrations for the involved brands, 3). We continue to grow and distinguish our collegiate presence via leagues, on-campus events, and content through CSL, the largest footprint in the collegiate esports space; over 1600 involved colleges and universities, operating 13 leagues/games, and culminating/spotlighting all of this through our CSL Grand Finals, essentially our North American ‘Final Four’ for each of our collegiate leagues and which takes place at the end of every collegiate year.

On Black Ops 4: This will be our fourth annual COD tournament for our WorldGaming North American Championship series, this year featuring Black Ops 4, we have now a legacy of creating and operating large scale COD tournaments thanks to a ton of amazing support coming from MLG and ATVI as well as from our huge community of COD players and fans, and again largely positioned for the aspirational and grassroots teams. This year we are projecting over 700 teams to participate and compete in our event, it has become a hallmark of a campaign and event for us ever since we started with the COD franchise in 2016.

ROSTER MOVES

CAA is adding to DrDisrespect aka Twitch live-streamer Herschel “Guy” Beahm IV to its roster for representation in all areas. THR broke the news, writing that his following has grown to more than 3 million, making him one of the platform’s most-followed gamers., while his Twitch channel has generated more than 100 million views.

Meanwhile, talent management and digital marketing agency Night Media announced the signing of MrBeast, currently one of the fastest-growing YouTubers in the world. MrBeast has 14 million subscribers and is gaining more followers at a rate of 1.5 million each month.

Hi Rez founder and CEO Erez Goren is reportedly stepping down after fifteen years leading the company. He will be succeeded by Stew Chisam, the company’s current VP of operations.

G2 Esports continues to add firepower to its executive ranks, announcing the additions of Commercial Director, Lindsey Eckhouse, and Partnership Executive, Sabrina Ratih, to the senior management team where will help lead G2 Esports in gaining new strategic partnerships and expanding existing relationships to support the growth of the company towards a global future. Eckhouse spent over 6 years managing and leading international commercial partnerships for the National Football League as Director of Partnerships and International Commercial and Marketing Manager. Ratih, Partnership Executive, has 12 years of experience in sales, partnerships, marketing, sports, media, and account management across a variety of industries.