For Michael Giusti, an analyst and writer with insuranceQuotes.com, effective communication isn’t accidental; it’s a deliberate process of aligning the right message with the right audience through the right channel.

For Michael Giusti, an analyst and writer with insuranceQuotes.com, effective communication isn’t accidental; it’s a deliberate process of aligning the right message with the right audience through the right channel.How does marketing in the insurance industry differ from other sectors?

When I am approaching what I do, I think of what I call the Magic Publication Formula: Audience, Medium, Message. You really need to start by saying “who am I talking to?” The audience really defines the tone and content of your messaging. You also need to think through how exactly you will deliver that message to that audience. But without starting by asking who you are talking to you are really a ship drifting without a destination. For us there can be a few distinct audiences – consumers for sure, but also brokers and insurance professionals.

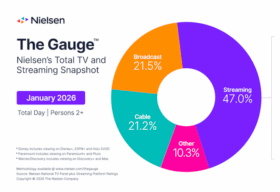

Once you define who you are delivering the message to, you need to figure out the best medium to use in order to get it in front of them. Where are they? Don’t spend time wishing you could draw them to your platform. Find ways to communicate using the media they already consume in the format they are already consuming it. For InsuranceQuotes.com that takes the form of written pieces on our home site, sure. But it also means doing guest bylines, media appearances and social,

too.

And finally, you should be thinking about message. It is essential that you think through audience and medium first, because that drives the form of what you are going to say. If you are just cutting and pasting the same message across all media for all audiences, you are doing it wrong.

What is the biggest challenge in marketing insurance?

While the approach to marketing is largely the same across most fields, insurance does have its unique challenges. For one, it is a very complex product. Everyone kind of feels like they understand insurance, but when you really get to the nuts and bolts of it, what people understand is the superficial “I pay my bill and they protect me” aspects. There is so much nuance. The challenge is presenting a rich message, but doing it in a conversational and approachable format.

The other huge challenge of marketing insurance is that insurance is a product you only use when something has gone incredibly wrong. That doesn’t prime people to be in a good mood when they interact with your product. House caught fire? Talk to your insurance agent. Car crashed into a tree? Get a cancer diagnosis? Loved one dies? You get the picture. So, a lot of the value in marketing insurance is to explain the nuance to the audience before they need to use the product. If someone

is trying to do research in the midst of a crisis, you aren’t likely to get the best information across.

One of the big opportunities insurers have to communicate when it isn’t a crisis is when the policy is up for renewal. That’s also the moment that many consumers turn to InsuranceQuotes.com. Our site is a tool people can use to compare rates across many different companies and drive their price down. By getting ahead of renewal and reassessing their policies, consumers can find coverage that fits their needs better and often at a lower price.

What would a campaign need to have to attract younger consumers, who are less likely to think about insurance?

This goes right back to that audience, medium, message formula. I think reaching younger audiences really is going to hinge on short video, whether that is on YouTube or TikTok or Instagram. Since the audience is youth, and the medium they are consuming is short-form video, then the message needs to really be something that is engaging and also visually appealing, but at the same time, it needs to be informational and useful.

There are some touchpoints for young consumers that can resonate in these spaces. For example, you could explain that if they throw a party and over serve their friends at a party, there are some states that allow an accident victim to sue the host if someone gets into a crash as they drive home. That might not be the first thing a 23-year-old is thinking about, but it is a valuable opportunity to talk about renters insurance that would protect them from that lawsuit.

Clicks for their own sake is a fool’s errand. There needs to be a reason you are delivering that message, and that needs to be beneficial both to you as the marketer, but also beneficial to them as the consumer. And it has to be approachable. So, that’s the whole trick, isn’t it?

Since you began writing about insurance, how has your own writing and communication approach evolved in recent years? And more broadly, how is digital transformation changing the way insurance companies approach marketing?

My biggest learning curve was adapting to an authoritative voice. Early in my career I was a journalist and attributed everything to some source. Now as an analyst, I am the expert – which was hard to wrap my head around. Learning how to explain things in my own voice authoritatively took some getting used to.

As for the second part of your question, this is probably where I am supposed to say that search engine optimization and gaming the algorithm is the name of the game, but I am a bit of a heretic here. Of course, there are some best practices that you should always be following: use good key phrases, use them throughout the story, answer questions that would logically come up, write good headers and useful story tops. But when people go over the top and have a huge list of things you “must” do to get the all-powerful algorithm to put your work first, they are more often than not

lying to you.

A good rule of thumb is this: write for humans, with Google in mind. Follow best practices. Sure. But really focus on making good, authentic content that is relevant and useful to the audience you are trying to reach.

How is AI reshaping the way insurance brands deliver their marketing campaigns?

AI is a great tool. I keep telling myself it isn’t as good as I am and that marketers will need human writers, at least for the near future, but maybe I’m just saying that so I can sleep at night. Who knows. For now, I think the human writers still have authenticity that today’s generative AI doesn’t yet have. I think AI is best used as a tool – I like to say it should be used like you use a friend at the coffee maker at work.

Should you ask them if a story idea is a good one? Sure. Should you ask them what topics you should include? Of course. Should you ask them what you are missing? Why not. But should you ask hem to write your piece for you? Of course not.

What can traditional insurers learn from the newer insurtech brands? And what can insurtech brands learn from traditional insurers?

Insurance is an achingly conservative industry, largely because it is so regulated. About 10 years ago there were tech founders who came in and promised they were going to change everything about insurance and shake it all up. Then they ran face first into the regulators.

Insurtech did change the industry. Underwriting is much faster than it used to be. Claims processing is much more efficient. They came up with some amazing tools on the back end that really innovated the industry. But what they didn’t do is put the old-line insurers out of business. They kind of melded into the existing industry and the alloy that came out made both the insuretech and the traditional insurers stronger.

Really narrow down your focus. Who are you trying to talk to? Define that first. If you just go out and start saying things, you won’t be very effective. You may as well walk out to the street corner and start yelling it to whomever passes by. Think audience first. Then medium. Then message.