The fractured television landscape

While streaming continues to grow, linear television still commands approximately 50% of total viewership in many markets. It still dominates daily media consumption. Even within the streaming universe, the way inventory is bought and sold follows distinctly different paths that many marketers fail to recognize. Understanding these dynamics is crucial for developing an effective, comprehensive television strategy.

The most critical distinction lies in how streaming inventory reaches advertisers. Premium streaming publishers overwhelmingly prefer to sell their inventory through direct insertion order (DIO) arrangements rather than programmatic marketplaces. This preference stems from the guaranteed yield DIO provides for all impressions, compared to the nonguaranteed fill rates inherent in programmatic exchanges.

Major streaming platforms typically sell a substantial amount of their most valuable inventory through direct channels at fixed rates, reserving these premium placements for advertisers willing to commit upfront. The inventory that eventually makes its way to programmatic platforms generally consists of remnant impressions that weren’t sold through preferred direct channels.

This bifurcation creates a situation where programmatic buyers often access a limited pool of inventory that represents neither the full breadth nor the premium quality of the streaming universe. Evan Shapiro’s media universe map visually represents this disparity, illustrating just how small the programmatic CTV portion is compared to the total available television impression marketplace.

This reality fundamentally challenges the notion that programmatic CTV alone can serve as a complete television solution.

Programmatic’s promise and pitfalls

Don’t get me wrong, programmatic CTV offers undeniable advantages: granular audience targeting, real-time optimization and flexible buying models that appeal to performance-focused marketers. However, the limitations of this approach become apparent when examining the broader television advertising ecosystem.

The first limitation concerns inventory quality and availability. Premium content creators prioritize direct sales channels for their most valuable inventory, including hit shows, live events and season premieres. A programmatic-only approach effectively removes a brand from consideration for these high-impact placements. For instance, while a trading desk might access some inventory on platforms like Hulu, it’s unlikely to secure premium positions during highly anticipated shows like “The Bear,” where direct buyers often control entire commercial pods.

Supply-path transparency presents another significant challenge. When purchasing through programmatic channels, the same inventory may be available through multiple intermediaries, creating a convoluted supply chain.

Consider free ad-supported television services. The inventory on these platforms might be offered through dozens of different sellers when accessed via programmatic platforms. This complexity not only introduces potential inefficiencies, increased costs and the potential for fraud, but also raises questions about inventory authenticity and placement quality.

Brand safety concerns further compound these issues. Recent industry conversations have highlighted limitations in third-party verification services like Integral Ad Science, DoubleVerify and Moat when applied to CTV environments. These tools often struggle to provide the same level of verification and transparency in streaming television contexts as they do on the web.

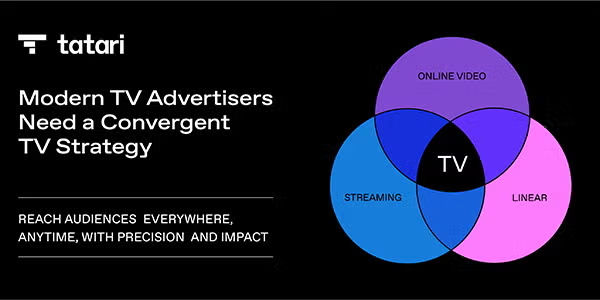

The convergent TV advantage

Convergent TV – encompassing linear broadcasts, premium streaming through direct buys and special programming opportunities – delivers unique advantages that programmatic CTV alone cannot match. These benefits extend beyond simple impression delivery to fundamental brand-building capabilities that have made television the preeminent advertising medium for decades.

Perhaps the most significant advantage is the “halo effect”: television’s unparalleled ability to drive awareness and consideration that subsequently improves performance across other marketing channels. When consumers encounter a brand in premium television environments, they’re more likely to engage with that brand’s search and social media advertising, increasing conversion rates across the entire marketing funnel.

This effect requires both broad reach and premium context – precisely what direct television buying provides and what programmatic CTV often lacks.

Premium placement opportunities represent another critical advantage of direct television buying. Sponsorships, content integrations, special event participation and category exclusivity are typically unavailable through programmatic channels. These high-impact opportunities often create the most memorable advertising moments, whether through sports championship sponsorships, award show integrations or other cultural touch points that programmatic buying simply cannot access.

Contrary to common perception, direct television buying can also offer cost advantages. While programmatic platforms excel at targeting precision, this capability comes at a premium. Direct buys typically provide more favorable pricing for premium inventory, particularly when secured through upfront commitments. The efficiency gap widens further when considering the “ad tech tax” associated with programmatic supply chains, where multiple intermediaries each take a percentage of the media spend before it reaches the actual publisher.

Finding the right balance

The solution isn’t abandoning programmatic CTV, however, but rather positioning it appropriately within a comprehensive television strategy. Programmatic represents just one component of an effective approach, perhaps 10% to 20% of total television investment.

A balanced television strategy integrates linear television, direct streaming buys and programmatic CTV in proportions that reflect both current viewership patterns and strategic marketing objectives. This approach maintains sufficient reach through traditional television while leveraging streaming’s targeting capabilities, ensuring brands connect with their audiences across the entire viewing spectrum.

Furthermore, direct relationships with television publishers provide several strategic advantages. Beyond preferential inventory access, these relationships often include custom research, audience insights and creative collaboration opportunities that programmatic platforms rarely offer. These partnerships can transform television from a simple media channel into a strategic business relationship that drives both immediate performance and long-term brand development.

Measurement remains an essential consideration when balancing different television approaches. While programmatic platforms excel at attributing direct response metrics, they often struggle to capture television’s full impact, particularly its influence on other marketing channels. Sophisticated incrementality testing methodologies have emerged to address this gap, helping marketers understand how television exposure across both traditional and streaming environments drives overall business outcomes beyond immediate attributable conversions.

The role of trusted partners in the future of TV media buying

Television advertising has never been more powerful or more complex. The proliferation of viewing options, buying methodologies and measurement approaches creates both challenges and opportunities for today’s marketers.

Those who recognize programmatic CTV’s proper place within the broader television ecosystem position themselves to be able to tune in to television’s full potential.

For more articles featuring Andy Schonfeld, click here. |