Cathy Applefeld Olson

Brands are facing three key challenges in the current environment: Adapting experiences and messaging, finding where audiences have shifted their attention and delivering value to those audiences in these new locations via advertising. This according to Dan Robbins, Roku VP of ad marketing and partner solutions. Robbins details Roku’s new OneView ad platform and incremental reach guarantee and other facets of the streaming platform’s inaugural NewFront presentation slated for Monday June 22..

What are the primary messages Roku is delivering to advertisers this year?

We have three clear focus areas for our first ever Newfront. First is agility—empowering marketers with the freedom to adjust while being flexible to individual buyer and brand needs. The second is control—the need to deliver the message a marketer wants to send today, not months ago. And the third is value—the need to measure results when every dollar counts.

These priorities align with our launch of OneView last month, our new ad platform that manages advertising across OTT, desktop and mobile campaigns in one place, and build from our conversations with brand partners that have made it clear that they want to have these core elements included in every engagement from their platform partners regardless of campaign approach.

Can you explain your new incremental reach guarantee and why this year is the time to roll it out?

This is a game changer for marketers. Roku will offer incremental reach guarantees to brands for the first time this Upfront. Simply put, if a Roku home has already seen the ad on linear TV, the advertiser does not pay for that Roku impression. About half of our users don’t have pay TV. This guarantee allows brands to know they aren’t buying for the same audience multiple times.

What can we expect from Roku’s IAB presentation and your complementary roadshow?

Later this month, Roku will participate in its first ever NewFront presentation. In an industry first, we will also host “Upfront Roadshows” for brands across auto, CPG, finance/insurance, QSR/restaurant and telecom. Each vertical is getting its own Upfront where we will share new data, new planning insights, and new best practices and ideas tailored to the vertical. For example, we just recently announced a new shopper data program to make TV advertising more precise and measurable for CPG marketers with Kroger Precision Marketing as a launch partner.

These roadshows lead up to the June 22 NewFront presentation debuting details about our “Agile Investment Plan,” which is focused on the budget agility, messaging control and valued results for advertisers.

And in the spirit of bringing marketers an agile investment plan in the “streaming decade,” we are launching an Upfront hub so clients can actually stream the presentation from their couch using Roku. This hub will include the roadshows for viewing on demand, along with additional insights and modules. Our clients will receive what we call a “private channel” that they can download directly to their own Roku device to access content.

Roku has not yet signed a distribution deal with HBO Max. Is that something you foresee happening in the near future?

As a leading streaming platform we believe that HBO Max would benefit greatly from the scale and content marketing capabilities available with distribution on our platform. We are focused on mutually positive distribution agreements with all new OTT services that will deliver a quality user experience to viewers in the more than 40 million households that choose Roku to access their favorite programs and discover new content. Unfortunately we haven’t reached agreement yet with HBO Max. While not on our platform today, we look forward to helping HBO Max in the future successfully scale their streaming business.

What are the impediments to notching deals with streaming services? How do you anticipate the market will evolve in the coming months?

The increases in cord cutting and the launch of new streaming services benefit platforms like Roku. With our scale of 38.9 million active accounts and effective audience development tools, we can help these new services be successful on our platform.

In your conversations with advertisers, what trends are emerging as they enter the phased reopening of economies?

Brands are currently facing three key challenges in this environment: adapting brand experiences and messaging to the moment, finding where audiences have shifted their attention and delivering value to those audiences in these new locations via advertising.

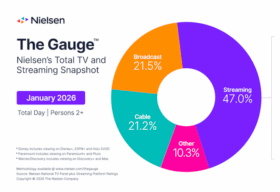

Upfronts were born of necessity in the ‘60s. Today, with both the traditional Upfront season and fall TV production facing uncertainty, most brands recognize the Upfronts must evolve once again. For instance, the ANA just called for the Upfronts to move from a broadcast year to a calendar year to offer agility.

As advertisers emerge from crisis mode, brands that want to catch up with consumers will need to shift more spend to streaming. Today, nearly one in two TV minutes for A18-34 is now streamed and more than four in five Ad Age 200 brands have spent on Roku. This shift to streaming was inevitable but the crisis pushed the behavior to take hold even faster—and it has no sign of going away but rather continuing down this path moving forward.

Are you seeing an increased desire from advertisers to connect with cause/social good messaging this year?

Absolutely. Brand messaging is even more critical than ever before. Less than two weeks after initial shelter-in-place, we launched our Home Together initiative, working with more than 20 partners to offer 30 days of free viewing through extended trials within the Roku Channel. Brands like Intuit TurboTax reallocated ad investment from March Madness to Roku’s “Home Together” Essential Movies and TV hub. We expect this Upfront will continue to focus on delivering value and mission-driven messaging to the consumer.