When Philip Inghelbrecht talks about the power of AI in advertising, he has the numbers to back it up.

“Two years ago, we were 280 people. Today, we’re still 280. Yet in revenue, we were half this size,” said the Tatari CEO. “So we doubled our business with the same group of people.”

Inghelbrecht credits that leap to Tatari’s engineering-first mindset and early adoption of AI, where the convergent TV platform embedded machine learning across measurement, planning, and operations, enabling scaling without adding (or losing) headcount.

The Convergent TV Reality

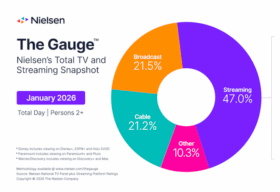

Streaming may dominate viewership, but ad dollars are still disproportionately allocated toward linear television. “We see that split as something like 60 to 40%,” Inghelbrecht said.

Tatari encourages advertisers to plan holistically across both. With more than 300 brands using the platform, most run linear and streaming in tandem. Those that also layer online video into their campaigns see a 13% efficiency gain.

Direct Deals Over Programmatic

Inghelbrecht is blunt about the economics, as programmatic fees can add up quickly. Tatari’s comparison with The Trade Desk shows costs that can reach 106%, effectively doubling media spend.

“The majority of impressions are still purchased in a direct setting, not programmatic,” he said. Direct deals not only cut costs but also eliminate fraud risk and improve brand safety. “Disney is never gonna sell a fraudulent impression to a client.”

To underscore the point, Tatari launched AdTechTax.com to illustrate how much of each ad dollar is allocated to intermediaries. Direct relationships also open the door to deeper partnerships, from sponsorships to program integrations, according to Inghelbrecht.

AI Beyond the Hype

When it comes to AI, Tatari didn’t implement it just for the heck of it. AI was rolled out across three key areas: automating internal processes, optimizing campaign outcomes, and assessing creative performance. Its most sophisticated application leverages “billions of performance events” to build media plans in seconds that outperform manual strategies.

“We have an insatiable appetite for data,” Inghelbrecht said, noting Tatari ingests roughly 150 million events daily by combining first-party data with impressions data for both measurement and planning.

That capability, he said, is a big reason Tatari was able to double revenue without adding (or losing) headcount.

Why Publishers Should Focus on Data

Publishers, Inghelbrecht noted, face a more brutal balancing act since linear carriage fees still carry weight even as engagement shifts to streaming. Many are also pouring resources into building their own ad platforms, which he argues is the wrong bet.

“I see virtually all big publishers trying to build their own ad platforms, and it actually doesn’t make sense,” he said. “Brands want one place to run their TV campaign, soup to nuts.”

Instead, he urged publishers to lean into data collaboration. Enriching impression data with contextual signals about programming and audience behavior — shared in privacy-compliant ways — will create more value for both buyers and sellers. “Together we’d be much better off,” Inghelbrecht said.