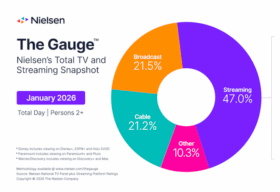

The streaming industry is approaching an inflection point that has little to do with content libraries or production budgets. The fundamental division emerging in 2026 is between platforms that control substantial first-party data and those that don’t. As third-party identifiers disappear and premium video consumption fragments further, this gap is creating a structural reorganization of economic power in the advertising market for connected TV.

The streaming industry is approaching an inflection point that has little to do with content libraries or production budgets. The fundamental division emerging in 2026 is between platforms that control substantial first-party data and those that don’t. As third-party identifiers disappear and premium video consumption fragments further, this gap is creating a structural reorganization of economic power in the advertising market for connected TV.

The New Competitive Reality

First-party data in CTV represents something qualitatively different from previous digital advertising approaches. Authenticated viewing sessions, device-level engagement patterns, and cross-session behaviors create datasets that reflect actual consumption rather than inferred intent. When aggregated at scale, these signals become the foundation for AI systems that can predict user behavior with increasing accuracy—and that accuracy translates directly into pricing power.

The economics are straightforward but consequential. Platforms with rich proprietary data deliver measurably better advertising outcomes, which commands premium pricing, which funds content acquisition and platform development, which attracts more users, which generates more data. This self-reinforcing cycle is already separating winners from those struggling to compete.

The Walled Garden Advantage

YouTube exemplifies the data-rich environment that independent streamers cannot replicate. Users logged into Google accounts connect television viewing to search history, location data, and purchase behavior across the broader Google ecosystem. This enables targeting and measurement that extends far beyond content preferences.

Amazon’s position is similarly formidable. Prime Video viewing integrates with e-commerce data, providing direct visibility into purchase behavior. Amazon can target ads based on shopping history and measure whether someone who saw an advertisement on Fire TV subsequently bought the product—a closed-loop attribution capability most CTV platforms cannot match.

Roku has built its entire business model around first-party data accumulation. Operating as both a device manufacturer and a streaming platform, the company has visibility into viewing behavior across over 80 million active accounts. Roku aggregates signals about what people watch, when they watch, how they navigate between apps, and how they respond to advertising. This data powers targeting capabilities across its ecosystem that traditional broadcasters have been unable to access for decades.

Disney leveraged its direct-to-consumer platforms, particularly Disney+ and Hulu, to build substantial first-party data assets. The company’s authenticated user base provides detailed viewing patterns across its content portfolio, while Hulu’s ad-supported tier generates specific response data. Disney’s ability to connect viewing behavior to theme park visits and merchandise purchases creates data integrations that inform both content strategy and advertising capabilities.

These platforms don’t just have more data—they have data that enables capabilities ad networks and trading desks cannot replicate. Frequency management across devices. Suppression of converted users. Sequential messaging strategies. Attribution that connects exposure to business results. Each capability requires not just viewing behavior data but connections between viewing and other user activities.

Traditional Networks Playing Catch-Up

Traditional television networks have approached this challenge with varying degrees of success. NBCUniversal’s Peacock operates as an authenticated platform, allowing the company to track viewing behavior across ad-supported and premium tiers—a significant evolution from panel-based measurement. Because Peacock sits inside Comcast’s broader footprint, NBCU can complement Peacock’s first-party streaming signals with additional deterministic household and viewership data from Comcast’s subscriber ecosystem—an input pure-play streamers may not have to the same extent. The company has also pursued collaborative approaches, making its advertising data available through clean room partnerships rather than keeping all proprietary signals locked internally.

Paramount consolidated its streaming efforts under Paramount+, as it introduces creating a unified platform for first-party data collection. The company’s ownership of Pluto TV adds another data stream, though the logged-out nature of much Pluto TV viewing limits signal depth compared to authenticated services. This highlights a critical challenge: scale without authentication provides less valuable data than smaller, authenticated audiences.

Fox Corporation took a different approach through Tubi, its free ad-supported streaming service. While Tubi operates largely without authentication, the platform’s scale generates substantial behavioral data. Fox has invested in technology to connect viewing patterns across sessions and devices, building data capabilities despite not requiring user logins. However, this approach has inherent limitations compared to authenticated platforms—probabilistic matching cannot match deterministic data for advertising precision.

Smaller services like AMC+ and Hallmark+operate authenticated platforms, but at scales that make comprehensive data-driven advertising capabilities difficult to develop independently. Their narrower content focus provides deep data within specific genres but limits the breadth needed to train high-performing machine learning systems.

Economic Consequences and Market Restructuring

These dynamics are reorganizing economic power in CTV advertising. Roku has leveraged its first-party data advantage to drive CPMs that compete with (or exceed) many non-premium linear TV placements, despite carrying content that would usually command lower rates. The premium reflects not content quality but targeting precision and measurement capabilities that logged-in viewing enables.

This creates a bifurcation: a tier of data-advantaged platforms commanding premium economics, and a larger group competing in a more commoditized environment where content quality alone doesn’t translate into advertising premiums. YouTube, Amazon, Roku, and Disney likely extend their dominance through superior advertising capabilities. Traditional networks investing heavily in streaming authentication, like NBCU and Paramount, occupy a middle tier where scale provides advantages but integration with broader ecosystems remains limited.

For platforms without comparable data advantages, the economics become challenging. They must compete primarily on reach or price, accepting lower yields to maintain advertiser demand. They struggle to justify premium pricing even when their content quality is high.

The Strategic Response

Recognition of this reality is driving new collaborative approaches. The formation of OpenAP by Fox, NBCUniversal, and Paramount demonstrates acknowledgment that mid-sized players need collective scale to compete with walled garden advantages. Clean room technologies allow multiple parties to pool signals while maintaining privacy and competitive boundaries.

These collaborations face real obstacles—competitive tensions, technical integration costs, and regulatory uncertainty. But the alternative is accepting permanent disadvantage. For many publishers, the value of participation in a larger data ecosystem outweighs the theoretical value of proprietary data that isn’t substantial enough to train competitive systems.

The question for 2026 and beyond is how dramatic these effects will be and whether collaborative approaches can create viable alternatives to walled garden dominance. The answers will shape not just advertising effectiveness but the fundamental structure and economics of television’s digital future. Publishers and streaming services must reassess assumptions about competitive moats: in this new landscape, the ability to deliver measurable advertising outcomes through deep proprietary signals or sophisticated data partnerships is becoming the defining competitive factor.