Pinterest’s move to acquire CTV performance advertising platform tvScientific came as a surprise to many, but it’s a smart strategic play, according to Dan Larkman, CEO and Founder of Keynes Digital. So what does the deal signal about broader shifts in the CTV landscape? Larkman shares his perspective.

Pinterest’s move to acquire CTV performance advertising platform tvScientific came as a surprise to many, but it’s a smart strategic play, according to Dan Larkman, CEO and Founder of Keynes Digital. So what does the deal signal about broader shifts in the CTV landscape? Larkman shares his perspective.

What strategic advantages does Pinterest gain by acquiring tvScientific?

The acquisition of tvScientific is a really interesting play for Pinterest, and a rare instance of M&A in the digital advertising space that came out of left field.

Marketing budgets for DTC brands tell a more matter-of-fact story to rationalize the news. Pinterest has fallen off media plans. And a lot of the brands I’ve talked to are moving away from it and focusing more on platforms like TikTok.

For Pinterest, this feels like their big push to reach more of those smaller, challenger brands and expand the capabilities of their offerings. Their data has always been incredibly compelling, but it’s become clear that, to succeed on CTV, they would have needed a partner; tvScientific plays that role, with a performance mindset included.

This combination allows Pinterest to re-enter brand conversations and compete more effectively for performance-driven budgets. Overall, I think it’s great news for the market and a very smart move for Pinterest.

How have the focus areas of early CTV players diverged over time, and what does that indicate about today’s CTV market?

In those early days of CTV, every company involved was just out to prove it could work.

Over time, the focus shifted, and companies developed distinct goals and strategies. tvScientific leaned more into an affiliate-style approach. MNTN focused on small companies. Keynes Digital focused on midsize and growth brands. We all carved out different positions, which is emblematic of a market that truly expanded. There’s no one simple use case anymore.

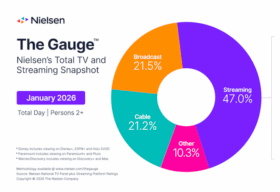

Over the last decade, CTV has grown to the point where different models, advertiser sizes, and strategies can coexist and succeed alongside what others offer. It’s a sign of a much more mature market.

How is consolidation reshaping the CTV market, and what does this acquisition signal for the future trajectory of CTV platforms?

I think there’s a lot of talk about consolidation right now, and for good reason. Everyone wants CTV. MNTN going public set a price for CTV companies, and we’ve seen that reflected in recent investments and acquisitions. tvScientific completed some investments right before its IPO, and its acquisition by Pinterest sends a fascinating signal to the rest of the industry.

To me, this is a sign that the market believes in CTV in the long term. You’re seeing brand investment go up, and now you’re seeing the market react to that brand investment. Consolidation is happening because the category has proven itself. Big platforms want in, and they’re not just testing, they’re buying.

Right now, it feels like a race, especially heading into the end of the year, and moves like this show who’s trying to get out in front of it. All of this tells me that everything is trending up and to the right for CTV.

How are shifts in marketing budgets reshaping performance expectations and investment priorities within the broader CTV ecosystem?

When I talk to brands today, especially DTC brands, the conversation has changed. A lot of budget has moved toward TikTok shopping, where performance is really front and center. That shift has raised expectations everywhere else. Brands want performance, data, and proof.

That’s why CTV is in such an interesting position right now. Platforms that can deliver performance and leverage strong data are going to win. And that’s also why acquisitions like Pinterest and tvScientific make sense; it’s about meeting where budgets are going and where expectations are headed. The market is reacting because brands are investing, and that momentum is only continuing.